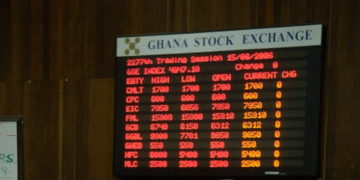

Market activity on the Ghana Stock Exchange (GSE) contracted sharply in August 2025, with both volumes and values traded posting steep declines from July levels.

According to official data, a total of 45.90 million shares worth GHS 203.63 million exchanged hands during the month, representing an 87.19% slump in volume and an 88.23% drop in value compared to July.

Despite this month-on-month contraction, annual comparisons showed trading volumes up 105.54% and value rising 15.76%, while year-to-date volumes dipped 14.98% against a robust 123.00% increase in value relative to the same period in 2024.

The equities market itself reflected mixed fortunes. The GSE Composite Index (GSE-CI) advanced 4.84% to close at 7,330.37 points, pushing its year-to-date gain to 49.95%.

In contrast, the GSE Financial Stock Index (GSE-FSI) edged down 0.44% to 3,411.96 points, though it still maintained a strong 43.31% rise since the beginning of the year. The figures highlight a shift toward higher-value transactions, even as overall market activity moderated.

Market sentiment in August was largely shaped by price movements. Cocoa Processing Company PLC led the gainers with a 50.00% surge, followed by Intravenous Infusions PLC (+25.00%) and Trust Bank Gambia PLC (+10.00%).

Other advancers included Clydestone Ghana PLC (+10.00%), Scancom PLC (+9.01%), NewGold (+8.16%), Ghana Oil Company PLC (+7.94%), GCB Bank PLC (+5.15%), Republic Bank (Ghana) PLC (+4.76%), and Ecobank Ghana PLC (+2.73%). On the downside, Ecobank Transnational Inc. lost 6.10%, with Cal Bank PLC (-5.56%), Unilever Ghana PLC (-0.44%), and Access Bank Ghana PLC (-0.12%) also closing lower.