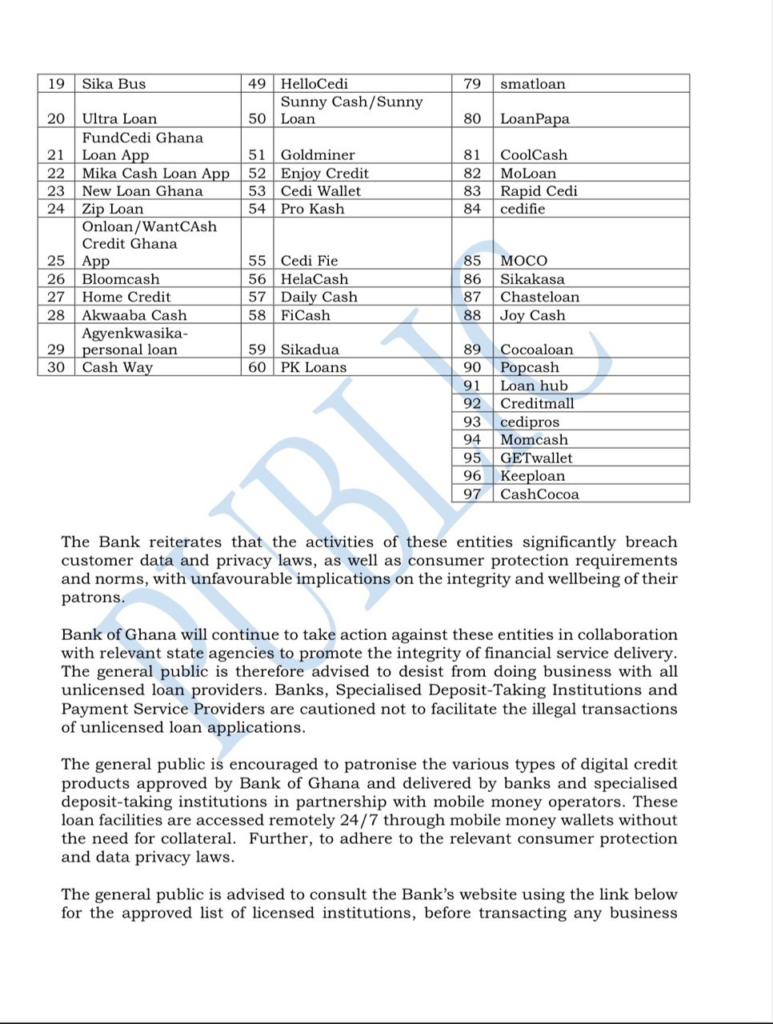

The Bank of Ghana (BoG) has cautioned the general public against transacting with some 97 unlicensed entities that are engaged in the provision of loans through mobile applications.

Some of the entities include Prime Loans, Cediboom, Happy Loan, Quick Cash and Bloomcash.

In a recent press release, the Central Bank stressed that the operations of these unlicensed entities is in contravention of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), with significant breaches in customer data and privacy laws and consumer protection requirements and norms.

It further advised the general public to be mindful in their routine business transactions by patronising digital credit products approved by the Bank of Ghana only and delivered by banks and specialised deposit-taking institutions in partnership with mobile money operators.

Read below the full statement by the BoG: