The President of the Mobile Money Vendors Association, Evans Otumfuo, has urged customers to remain patient as the full implementation of the Electronic Transfer Levy (E-Levy) repeal is yet to take effect.

Speaking on ABC News’ Prime News on Wednesday, Otumfuo clarified that there may be no formal announcement regarding the cessation of the levy on mobile money transactions, as the process involves coordination between the Ghana Revenue Authority (GRA) and telecommunications companies.

He assured customers that his association would actively engage in sensitization efforts to ensure clarity on when the changes would take effect.

“By 12 a.m. today, we should see E-Levy removed from mobile money transactions, and therefore all taxation should cease on such transactions,” he stated.

Otumfuo urged the public to exercise patience as the necessary adjustments are made.

“Sooner than later, the expectation of the law will be implemented,” he said, emphasizing that within 24 hours, the new policy should reflect on the mobile money platform.

Background

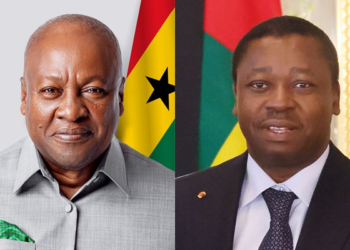

President John Dramani Mahama recently signed into law several tax repeal bills, including the Electronic Transfer Levy (E-Levy), Betting Tax, and Emissions Tax, fulfilling a key campaign promise of the National Democratic Congress (NDC) to ease the financial burden on Ghanaians.

The move followed the presentation of eight tax-related bills to Parliament by Finance Minister Dr. Cassiel Ato Forson on March 13, 2025.

The legislation included the Electronic Transfer Levy (Repeal) Bill, 2025; Emissions Levy (Repeal) Bill, 2025; Income Tax (Amendment) Bill, 2025; and the Earmarked Funds Capping and Realignment (Amendment) Bill, 2025.

The E-Levy, introduced in 2022, imposed a one percent charge on electronic transactions, including mobile money transfers and online payments. The betting tax required a 10 percent charge on gross gambling winnings.

With these taxes now repealed, mobile money vendors and customers eagerly await the full implementation of the policy change.