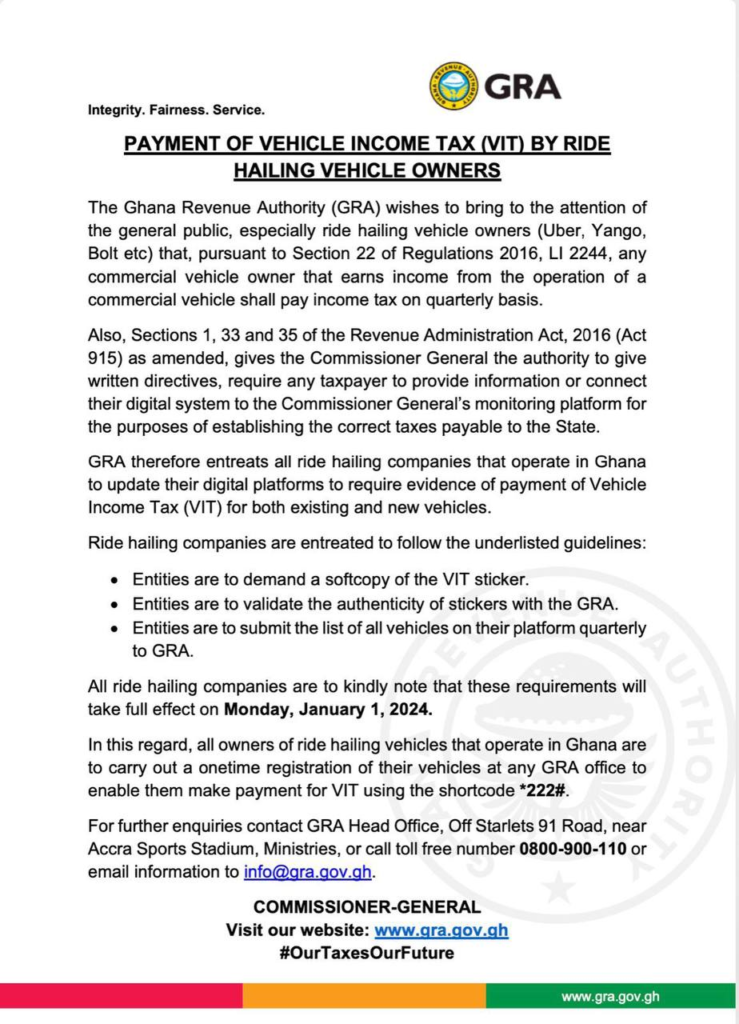

The Ghana Revenue Authority (GRA) has issued a notice to operators in the ride-hailing sector, regarding the implementation of the Value Income Tax (VIT) beginning from January 1, 2024.

In a statement released by the Authority, it cited Section 22 of Regulations 2016, LI 2244, which specifies that “any commercial vehicle owner that earns income from the operation of a commercial vehicle shall pay income tax quarterly.”

Thus, the Authority has advised ride-hailing companies such as Uber, Yango, and Bolt operating in Ghana to update their digital platforms to integrate the new tax requirements.

The GRA has emphasized that these requirements will be enforced on January 1, 2024.

Below is the full statement by GRA