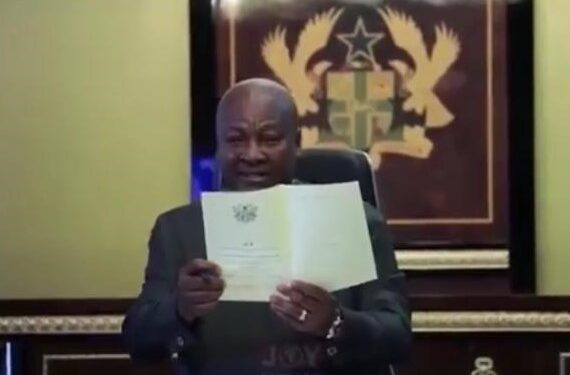

President John Dramani Mahama has officially given his assent to repeal the COVID-19 Health Recovery Levy, delivering on a major campaign promise to abolish what he has long described as an unnecessary and burdensome tax on Ghanaians.

The repeal, signed on Wednesday, eliminates the 1% levy that has been charged on goods, services and imports since 2021. The levy was originally introduced at the height of the pandemic to support national recovery efforts, but its continued implementation in the years after COVID-19 had subsided drew widespread criticism from businesses and consumers.

Parliament passed the repeal last month as part of the government’s broader agenda to scrap “nuisance taxes” and ease the escalating cost of living. With the President’s assent, the removal of the levy will officially take effect in January 2026, aligning with the start of the new fiscal year.

The original COVID-19 Health Recovery Levy, enacted under Act 1068 on 31 March 2021, applied an additional 1% tax on the value of taxable supplies, including imports, on top of existing consumption taxes such as VAT, the National Health Insurance Levy and the GETFund Levy. Though it was justified as a temporary measure, the levy stayed in force long after the pandemic and the 2020 elections had passed.

Speaking moments before signing the repeal, President Mahama said the tax had long outlived its purpose and had unfairly weighed on ordinary households.

“This is the Covid Health Recovery Repeal Act 2025, and it’s my honour and privilege to sign to repeal the Covid levy. Promise made, promise delivered, and today is the 10th of December 2025,” he declared.

He criticised the circumstances under which the levy was introduced, arguing that it contradicted earlier assurances from the previous administration.

“Purported to provide free water, free electricity, free food and a lot of things, and then to the shock of Ghanaians… after the pandemic was over and after the elections were over, the government slapped Ghanaians with a 1% Value-Added Tax ostensibly to recover what it’s supposed to have spent on the Covid pandemic,” he said.

President Mahama added that Ghana had become “one of the only countries where we’re being taxed for the pandemic that had passed,” stressing that the repeal was a key pledge of the New Democratic Congress.

“A lot of Ghanaians have disliked this tax, and today I am pleased that on the 10th of December 2025, I’ve signed the repeal act to remove the 1% Covid levy, and I will present it to the Clerk of Parliament,” he noted.

The repeal is expected to bring modest but meaningful relief to consumers and businesses, especially in the retail and services sectors where the levy contributed to rising operational costs.

It also forms part of the government’s strategy to streamline the tax regime, improve compliance and restore confidence within the business community.

The Ministry of Finance is expected to issue detailed implementation guidelines in the coming weeks ahead of the levy’s removal in January 2026.