Ghana has witnessed an expansion in its tax base, with the number of taxpayers rising from 3 million to nearly 12-13 million people over the past eight years.

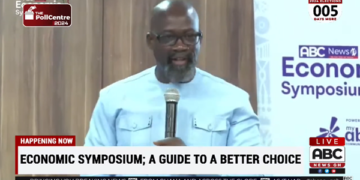

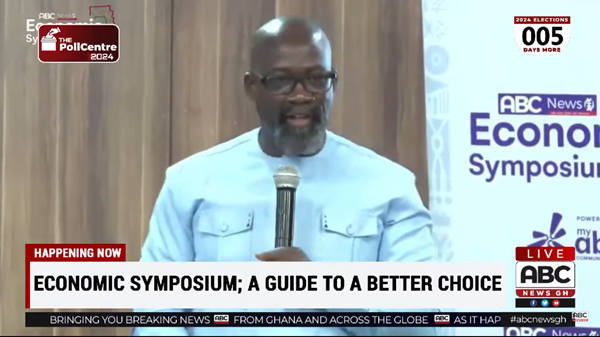

Speaking at the ABC Economic Symposium on December 2, 2024, Dr. Edwin Alfred Nii Obodai Provencal, Managing Director of BOST, attributed this growth to targeted formalization efforts.

“Those still operating outside the formal system will eventually be brought in as they transact with formal entities, ensuring gradual integration into the tax system,” Dr. Provencal stated.

The symposium also highlighted a significant boost in Ghana’s gold reserves under President Akufo-Addo’s leadership.

Dr. Frank Bannor, Lecturer at GIMPA and Head of Research at the Danquah Institute, revealed that the country’s reserves have surged from 8.7 metric tonnes in 2016 to 72 metric tonnes in just eight years.

He noted, “This exponential growth underscores the government’s strategic focus on resource management and economic strengthening.”

Dr. Bannor stressed the need to sustain this progress through local gold purchase programs, which he described as vital for reducing reliance on dollar reserves.

“Building our domestic gold reserves is critical for ensuring economic stability and maintaining the achievements we’ve made so far,” he emphasized.

The symposium, themed “A Guide to a Better Choice,” brought together economic experts to discuss key issues such as job creation, credit scoring systems, flat-rate taxation, and the Free SHS program.

Participants lauded the government’s efforts to broaden the tax base and strengthen economic foundations, underscoring the importance of inclusive policies to drive long-term growth.