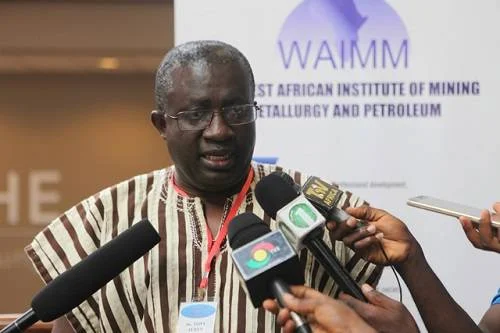

Former CEO of the Minerals Commission, Tony Aubynn, has expressed concerns over the lack of development in areas rich in natural resources despite their contribution to national revenue.

He called on the government to focus more on these regions, emphasizing that “it is important that government dedicate attention to areas where our natural resources are exploited to feed the entire nation.”

Aubynn’s remarks come at a time when calls for a more transparent mineral revenue management system are intensifying.

The Ghana Chamber of Mines has urged the government to enact a Mineral Revenue Management Act to ensure better accountability and transparency in the use of mineral revenues.

Ahmed Nantogmah, Director of External Relations and Communication at the Chamber of Mines, believes that “enacting a legal regime for the management of mineral revenue would enhance transparency, allowing citizens to better understand and appreciate the sector’s contribution to national development.”

His sentiments are echoed by Aubynn, who stated that the Chamber’s proposal “has got to deal with revenue, so it’s only to create transparency.”

With the Ghana Revenue Authority (GRA) reporting an 81.1% growth in mining sector tax payments from GH¢6.38 billion in 2022 to GH¢11.55 billion in 2023, the sector has become the largest source of direct domestic tax revenue. However, many question whether mining communities are truly benefiting from this wealth.

Gold, which contributed GH¢37.0 billion (57.6%) of Ghana’s total export value in Q2 2024, continues to be the primary driver of Ghana’s export earnings.

Yet, without a clear legal framework, the wealth it generates may still fail to translate into meaningful development for the communities at the heart of its extraction.