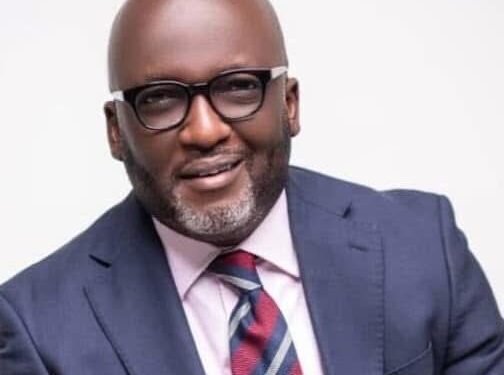

The Chief Executive Officer of the Ghana Infrastructure Investment Fund (GIIF), Nana Dwemoh Benneh, has disclosed that authorities are working with some development partners to establish an infrastructure credit guarantee scheme.

Speaking at the International Building-Infrastructure & Investment Expo (IBIXPO 2025) in Accra, he explained that the initiative, when operational, will allow Ghana to engage pension fund managers more effectively and encourage them to channel part of their funds into project financing.

“If we are able to do it, that enables us now to speak more to the pension fund managers and encourage them to invest part of that pension money in project financing,” he noted. He added that the scheme would ensure the country had access to local currency financing, thereby raising sustainable funds for infrastructural development in the long term.

Nana Benneh explained that the idea was inspired by the success stories in countries such as Nigeria and Kenya, where similar schemes have significantly expanded local capacity for financing major projects. He pointed to Nigeria’s Infrastructure Credit Enhancement Facility (InfraCredit) as a notable example.

Established in 2017 with an initial contingent capital of USD 25 million through its GuarantCo guarantee solution, InfraCredit has since become a specialised institution that enhances the credit quality of local currency debt instruments used to fund infrastructure projects. Over the years, it has attracted more capital and built a stronger balance sheet, enabling it to underwrite long-term local currency guarantees.

As of December 31, 2024, InfraCredit had successfully guaranteed 24 transactions, mobilising over NGN 200 billion in private investment with tenors of up to 20 years. It had also attracted the participation of more than 21 domestic institutional investors—representing around 60 percent of pension fund assets in Nigeria. Out of this, nearly NGN 150 billion worth of bond issuances were supported, with an average tenor of 11 years compared to the market average of 3.2 years without InfraCredit. Pension funds accounted for more than half of this participation, with many projects gaining first-time access to long-term local currency financing.

Highlighting the importance of such mechanisms, Nana Benneh stressed that with global regulations reducing the amount of bank capital available for Africa’s infrastructural needs, institutional investors—including pension funds, sovereign wealth funds, and insurance companies—had emerged as critical players in closing the continent’s estimated US$108 billion infrastructure financing gap.

“The mobilisation of institutional investment for infrastructure assets provides the backbone for Africa’s regional integration, trade, investment, and competitiveness,” he stated.

Deputy Minister for Works, Housing, and Water Resources, Gizella Tetteh-Agbotui, reinforced this call, urging stronger public-private partnerships to address the capital-intensive nature of infrastructure projects. She praised the objectives of IBIXPO 2025, noting that it was an important step toward bridging knowledge gaps, fostering collaboration, and unlocking new investment opportunities.

In her welcome address, Madam Eugenia France, an official of the Image Consortium Limited, organisers of the event, said the expo aimed to bring together stakeholders—including investors, policymakers, industry leaders, and construction professionals—to explore the potential of infrastructure development in West Africa.

The event also showcased innovative technologies and solutions expected to transform the construction and infrastructure landscape. According to the Chief Executive Officer of Global Afrisino, Albert Mensah, IBIXPO 2025 inspired actionable strategies for building resilient and future-ready infrastructure systems by sharing successful case studies and encouraging knowledge exchange.

Organised by Image Consortium in partnership with Global Afrisino, and under the auspices of the Ministry of Works, Housing, and Water Resources and the GIIF, the expo was held on the theme “Building Resilient Infrastructure for Sustainable Growth & Regional Integration.”