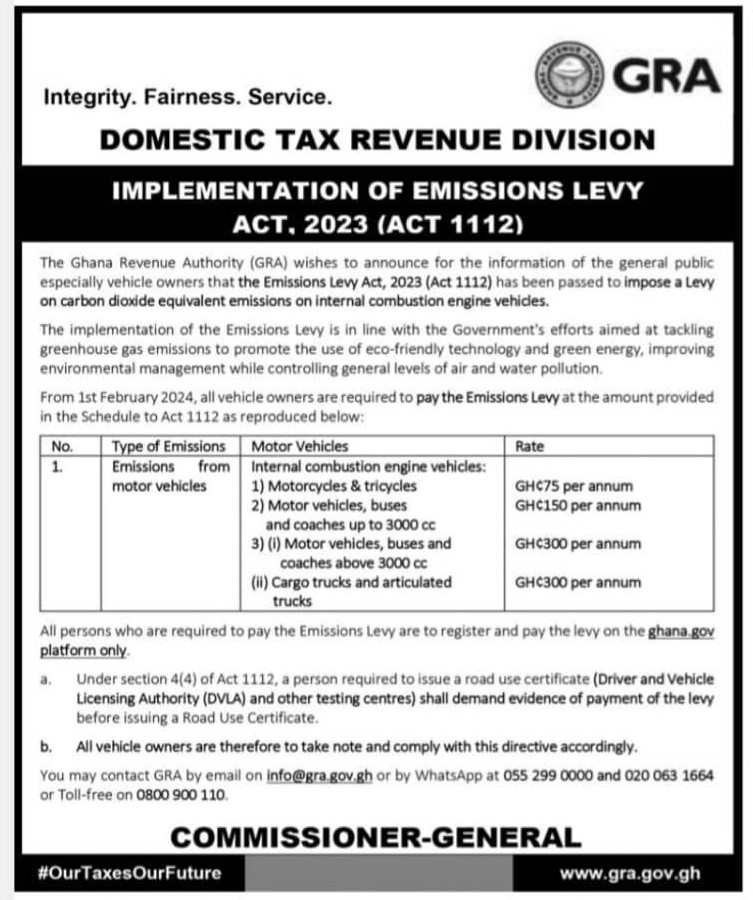

The Ghana Revenue Authority (GRA) has officially commenced the enforcement of the Emissions Levy Act, 2023 (Act 1112), effective February 1, 2024. This legislation, designed to curb carbon dioxide equivalent emissions, introduces a levy specifically targeting internal combustion engine vehicles.

The levy amount varies based on the type of vehicle and its engine capacity.

Motorcycles and tricycles are required to pay GH₵75 per annum, while motor vehicles, buses, and coaches up to 3000 cubic centimetres are required to pay GH₵150 per annum.

Motor vehicles, buses, and coaches above 3000 cubic centimetres, cargo trucks, and articulated trucks are required to pay GH₵300 per annum.

Under the provisions outlined in Act 1112, individuals falling under the purview of the Emissions Levy must complete registration and remit payments exclusively through the ghana.gov platform. Notably, the legislation mandates that entities responsible for issuing road certificates, including the Driver and Vehicle Licensing Authority (DVLA) and affiliated testing centers, verify levy payment evidence prior to the issuance of Road Use Certificates.

The GRA’s announcement emphasizes the importance of vehicle owners adhering diligently to the prescribed procedures and fulfilling their obligations under Act 1112 and underscores Ghana’s unwavering commitment to combatting greenhouse gas emissions and fostering sustainable practices within the transportation sector.

Read below the full details: