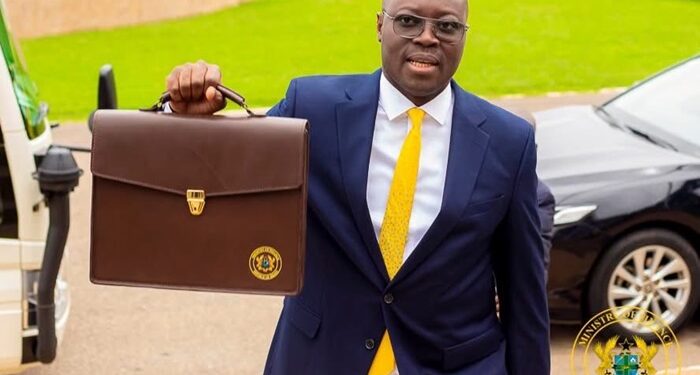

The 2025 Mid-Year Budget Review, presented today by Finance Minister Dr. Cassiel Ato Forson, painted a cautiously optimistic picture of Ghana’s economy.

Delivered in Parliament, the address came amid rising public expectations about government’s next steps on taxation, inflation, debt, and social spending.

While Ghana is not entirely out of the woods, the Minister declared that hope is in sight, backed by improving indicators and a strong determination to rebuild the economy.

Inflation has dropped from 23.5% at the start of the year to 13.7% by June, and the Ghana cedi has staged a sharp comeback—moving from GH¢15 to GH¢10.45 to the dollar.

This has translated into marginal price reductions and renewed confidence from the business community. On growth, the real sector saw a 5.9% expansion in services, while GDP figures from the first quarter already surpassed annual targets. But fiscal prudence remains key.

Dr. Forson emphasized that President Mahama’s administration inherited a struggling economy but has taken steps to stabilize key sectors, clean up payroll irregularities, and protect depositor funds.

Top 26 Key Notes from the 2025 Mid-Year Budget Review:

- NHIS Levy and COVID-19 Levy to be scrapped in 2026.

- Government to conduct regular payroll system audits to sanitize the wage bill.

- Payroll audit flags over 14,000 ghost workers, leading to GHS150 million in irregular payments.

- Public sector staff who validate ghost names will be held personally liable.

- Ghana’s fiscal position has significantly improved.

- The Ghana cedi has demonstrated exceptional resilience in 2025.

- Cedi depreciation in 2022, 2023, and 2024 has almost been fully reversed.

- Services in the real sector grew by 5.9%.

- GDP growth is expected to be sustained through the Big Push Agenda.

- Government saved GHS 4.9 billion on domestic interest payments as of June 2025.

- Inflation dropped from 23.5% to 13.7% and is on track to meet the 11.9% target ahead of schedule.

- Domestic interest payments reached GHS21.6 billion by June 2025.

- Non-oil tax revenue (NET) exceeded target by GHS787 million.

- Import duties underperformed by GHS1.6 billion.

- External interest payments totaled GHS3.8 billion.

- Government to list NIB on the stock exchange.

- NIB depositor funds of GHS6.4 billion have been secured.

- Bookrunners will be selected to support the reopening of the domestic bond market.

- All government contracts awarded in foreign currency are to end today.

- AI to be deployed in revenue management to reduce human interference.

- The government inherited GHS32 billion liabilities in the cocoa sector.

- Strong action pledged against illegal gold trade.

- Teacher and nursing trainee allowances from January to June have been fully paid.

- GHS9.1 billion disbursed to the energy sector to ensure stable power supply.

- GHS2.9 billion transferred to District Assemblies Common Fund.

- GHS191.7 million paid in teacher training allowances.

By Ruth Sekyi – [email protected]