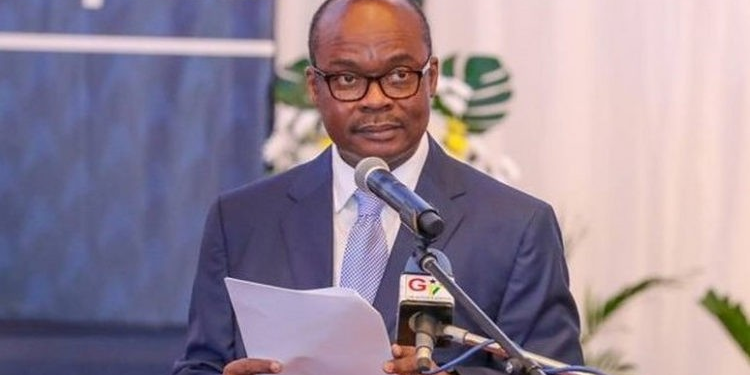

The Governor of the Bank of Ghana, Dr. Ernest Addison, has urged the Ghanaian public to acknowledge and appreciate the efforts invested in salvaging the struggling economy, despite the formidable challenges faced during this period.

Dr. Addison highlighted the commendable role of the central bank in preventing an economic breakdown, emphasizing the global shift in central banking responsibilities since the 2007/2008 financial crisis. He noted that central banks worldwide, in response to various crises, have expanded their mandates, collaborating with fiscal policies to counteract economic fluctuations, marking a substantial departure from their traditional role of regulating short-term interest rates to control inflation.

Addressing the Chartered Institute of Bankers on Governor’s Day, Dr. Addison noted that the evolving landscape necessitated unconventional monetary policies, challenging the conventional theories of central banking. He stressed that the Bank of Ghana’s actions during economic shocks were in line with prudent crisis management, citing the 2020 pandemic as an example where the central bank played a pivotal role in financing the budget to safeguard lives and livelihoods.

“In a world of polycrisis, central banks have found themselves broadening monetary policy formulation beyond interest rates to include the deployment of balance sheets in a variety of unconventional monetary policies. Thus, the crisis exposed a chasm between theory and practice,” he underscored.

He explained that “all the Bank of Ghana did as various shocks hit the economy was consistent with prudent crisis management.” He said that in the 2020 pandemic, the central bank supported the financing of the budget to protect lives and livelihoods.

Reflecting on the economic and liquidity crisis of 2022, Dr. Addison affirmed that the central bank’s response was consistent with its role as an automatic stabilizer. He underscored the crucial role of a well-managed central bank with sufficient buffers, asserting that only such an institution could effectively intervene to prevent an economic collapse.

“In the 2022 economic and liquidity crisis, the central bank would not have acted differently but played its role as an automatic stabiliser to avoid pushing the economy to a tipping point that possibly could have spilled into social upheavals, as was the case in Sri Lanka,” Addison recalled.

“It is very clear that only a central bank that has been prudently run, built buffers, and is well-positioned can step in to support an economy from collapse. “It is, therefore, most appropriate, I believe, to state that Ghanaians should rather applaud and commend the resilience of the Bank of Ghana,” he noted.